Regulators in Europe have sent a mixed message to the market, “Europe wants to attract you, and offers low tax incentives, yet if you do make a pile of cash, we’ll attempt to claw back the gifts”. Although I don’t believe it will materially impact on Apples phenomenal business performance I do think this presents an eye watering gift for the UK government. They have promised to attract inward investment to the UK Northern Powerhouse and this could be the catalyst..

Apple employs 115,000 staff globally and about 6,000 in Cork Ireland. Strategically it now faces the opportunity to enter the UK following the Brexit decision. If the Brussels action retroactively creates a tax rate greater than the UK extant 20% it would make sense for Apple to transfer at least the greater part of its operations to a low cost UK hub.

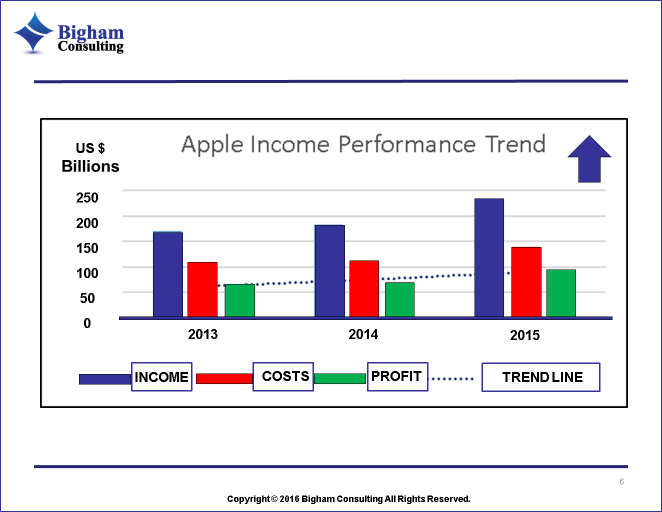

If we look at Apples Financial Performance, the first thing we notice is that they are incredibly profitable and cash generative. Most of their liquidity resides in securities in fact not cash, that would be crazy as it is about $200 Bn. This means the stock market will dent Apple far more than Brussels ever could. We’ll examine that a little later.

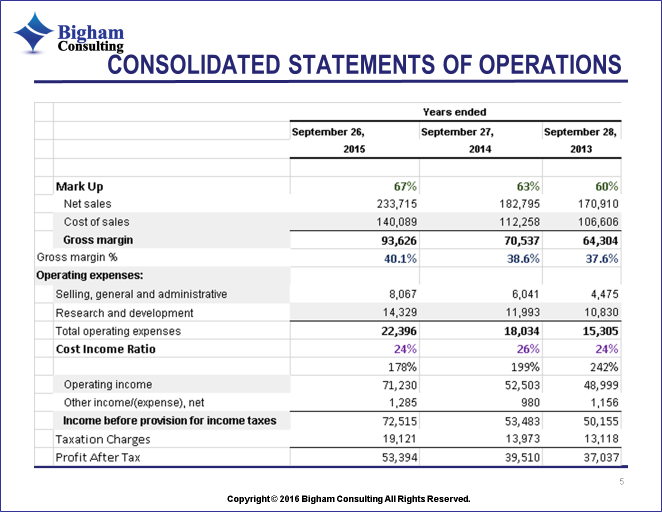

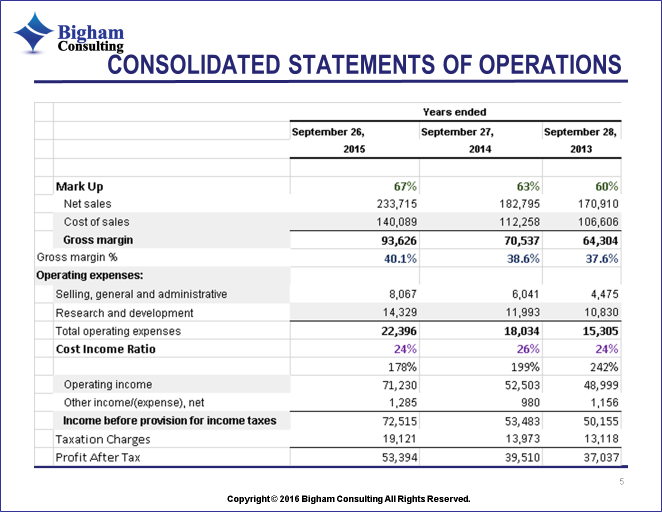

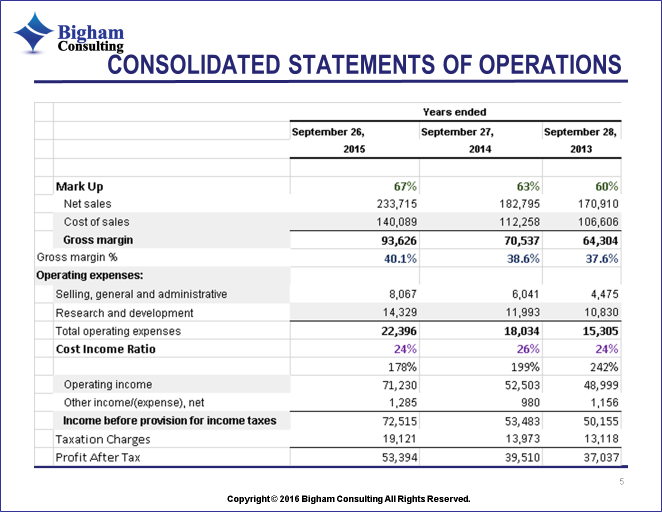

Contrary to what the headlines might lead you to believe, Apple does pay tax. Its accounts show a consistent 26% Tax Charge, resulting in an average $ 15 Billion in each of the past three years according to their official 2015 10K accounts.

Apples tax charge has risen over the last three years from $13.1 Bn in 2013 to whopping $19 Bn in 2015. An estimated Deferred Tax shelter from between $4 and $6 Bn resides on its balance sheet.

Apples Mark Up is phenomenal. It has risen from 60% to 67% . A 7% absolute or just 10.8% relative increase in three years. This suggests a highly efficient operating model with increasing product demand. But all is not rosy!

Net sales have grown a massive 36.75% since 2013 from $170.1 Bn to $233.7o Bn. Not bad, but particularly good when compared to costs of sales which have only increased a correspondingly 31.41% or $33.4 Bn over the course.

Gross Margin has thus taken a leap from a healthy 37.6% in 2013 to 40.1% in 2015 an incremental improvement of 6.47% or an absolute gain of 45.6% which translates to $29.3 Bn greater than two years ago.

Where I think their numbers are interesting is the cost base. It just doesn’t look right. The Cost Income ratio of 24% is near perfect and doesn’t seem to move. That might seem normal but it’s not when you look at the breakout of Research and Development Costs.

Apple has scaled back R&D massively which is balanced by an 80.27% hike in Selling and Administrative Expenses keeping Cost Income Ratios consistently snug at just 24%. It suggests a little engineering to me. I am concerned that the real R&D is capitalised and this will result in deteriorating Earnings on Assets.

If Apple sales are up 36% but the cost of customer acquisition increased 80% what does it suggest? Perhaps we are witnessing the initial decline in real product demand since the departure of Steve Jobs!

In 2015 Apple generated a massive $72.5 Bn profits before tax. It charged $19Bn to its tax reserve which has itself increased year on year, Apple might need to sell a few shares to pay the £11Bn tax bill, but I would imagine the capital gains charge would exceed the penalty Brussels is imposing.

Apples Earnings per share has risen in recent years. This is certainly interesting, rising from $5.72 in 2013 to $9.28 in 2015. This is at a time when the share price has been falling. Essentially the price has dropped as earnings have increased.

The company stock trades at 11 times earnings, down from 19 times in 2013. A multiple of 19 seems ridiculous to me even for a technology company. But the drop means Apple is now probably trading nearer to its real intrinsic value. Increasing US interest rates will also weigh on this valuation but I wont go into that here, just note it is not all operationally dependent.

What it means is the Market Capitalisation of Apple has corrected massively from near One Trillion US Dollars to $610 Bn or 60%. This suggests the market has priced in a correction to its intrinsic value based on a perceived reduction in the net present value of its future incremental cash flows.

Shareholder Value Add has thus Declined from circa 9 times the book value of equity to nearer a little above 5 times book. This is still an amazing premium to book as befits the genius of its products.

Apple has made substantial share buy backs to take advantage of the bargain and has compensated for this by increasing leverage with its debt to equity ratio rising to 143% from 107.8% making it a more efficient Return On Equity Generator.

Apple Returns on Equity are substantially higher than the best investment banks for example and have increased for all the reasons mentioned from 35% to 45%. in under two years.

Return on Equity – ROE (a key indicator of shareholder value) is of course not a Risk Adjusted number. It is based on earnings and capital. Reduced Equity capital and Increasing Earnings over time create a triangular effect with a widening GAP between the two.

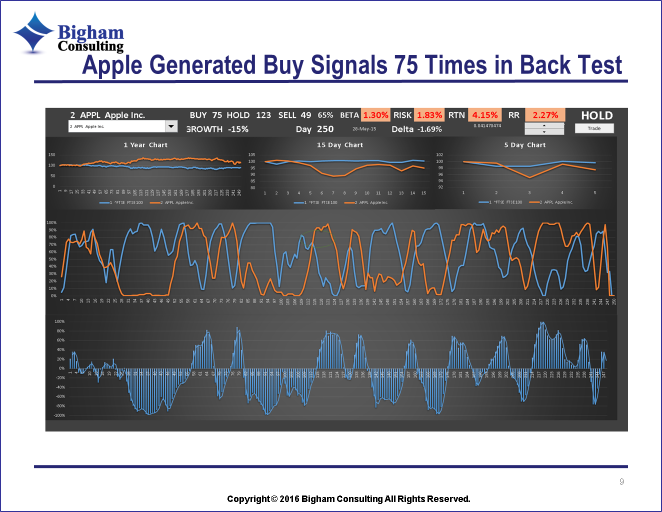

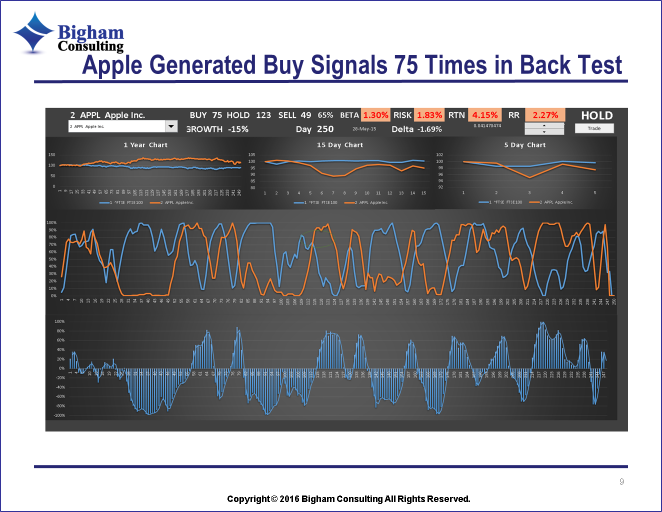

This risk factor is factored in by the markets. Apple is currently trading with a Beta Factor of 1.3. A Beta compares the Relative Risk of the Stock to the Risk of the Market. 1 is neutral and represents the market, less than one suggests a defensive stock and above one is an indicator of an aggressive stock.

The Risk Return Ratio on Apple at least in my personal calculations imply odds of 6.5 to 10 or a 65% Risk to Return Ratio. The upside is amazing but the risk is too high for me at least.

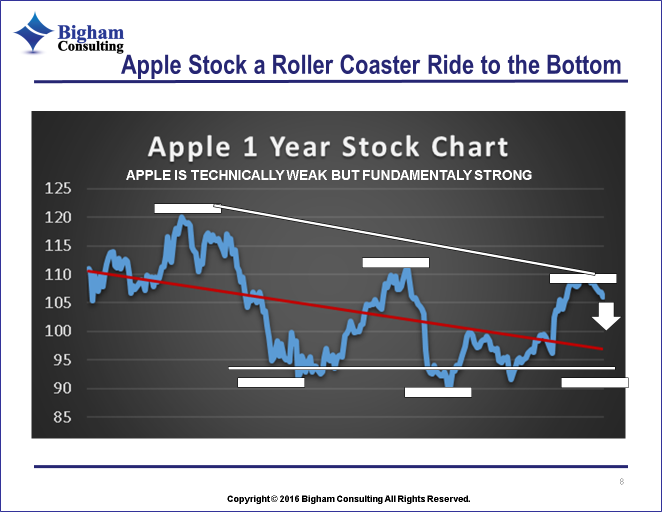

I see no slow down in Apples growth, but as it grows, it is becoming more of a roller coaster ride than I personally would be comfortable with. As Apples hammered stock price regains traction expect volatility to increase, it has of course decreased on the way down arguably making it a cheaper and safer bet than one year ago.

For more information and to download our guides please visit www.bighamconsulting.co.uk Notice to Investors: Please note Bigham Consulting is not an investment adviser and information on this blog is provided here for educational purposes only.

What the Trade Simulators Tell Us I back tested Apples stock to see if it generated any sell signals. It didn’t. My models suggest that Apple is fundamentally strong, yet perhaps technically weak for now. This is good. It makes Apple more of a fundamental bargain, yet technically not so. The difference is down to fundamentals and your view on “Value” versus “Technical” investing. I believe Apple is a solid company with seemingly endless opportunities for growth, yet we are reminded that is remains at the whim of regulators as long as it chooses to operate from any European hub,

The chart below illustrates this nicely.Charts courtesy of www.bighamconsulting.co.uk.

CEO & Founder

Eric started his professional career selling properties in the London Docklands before going on to qualify as a Chartered Certified Accountant. He has held senior positions in Consulting and Banking and his 25 years of experience are an asset to OMB.